Example of a Charitable Remainder Unitrust

This is an educational illustration and does not represent legal or tax advice. The value and cost numbers have purposely been selected as round numbers to allow for personal interpretation. The value used is not a minimum, maximum or suggested amount. Please consult your legal and tax advisors about your specific situation.

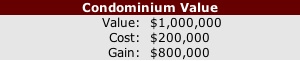

Mary and John Smith, both 70 years old, have a condominium they purchased a number of years ago. Initially they used it as a vacation home, but as they have gotten older and their children moved away from home and from the area, it gradually became an investment property. It is now fully depreciated and provides a return of about 4 percent after expenses.

At 70 years old they wish to avoid working with tenants and repairs to the condo. The Smiths have considered selling, but they have been slowed down by circumstances: Whom would they consider as the real estate agent? What about the necessary cleanup? What if they do not want to pay capital gain tax (15 percent) or the recapture of depreciation tax (25 percent)?

At 70 years old they wish to avoid working with tenants and repairs to the condo. The Smiths have considered selling, but they have been slowed down by circumstances: Whom would they consider as the real estate agent? What about the necessary cleanup? What if they do not want to pay capital gain tax (15 percent) or the recapture of depreciation tax (25 percent)?

Mary recently spoke with a friend who not long ago had been in a similar situation. She suggested talking with an attorney about donating the property since she knew the Smiths were very involved with several non-profit organizations. After meeting with a development officer, the Smiths sat with an attorney who suggested a Charitable Remainder Trust.

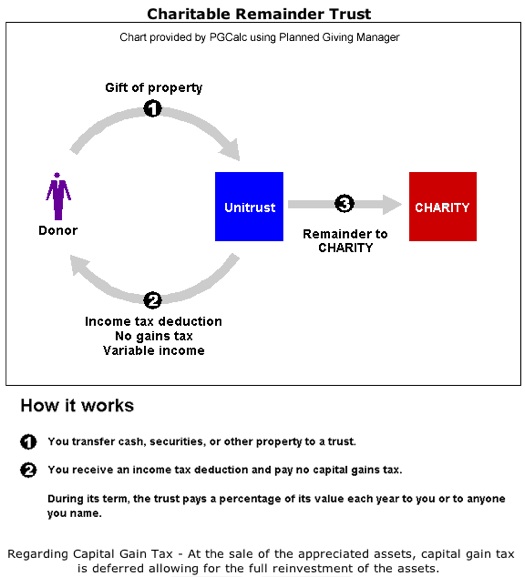

In their tax bracket, they could place the property in a charitable remainder trust that would sell the property and invest the proceeds in other investments without having to pay capital gain tax. The Smiths would receive an income for life based on a percentage of the assets in the trust. The trust would be revalued every year, and if the assets increase, their income would rise as well. After their lives, the remainder in the trust would go to the nonprofit organization of their choice.

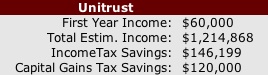

The attorney ran some numbers and suggested that the Smiths take a 6 percent payout from the trust ($60,000 the first year as opposed to the $40,000 they are currently earning). The attorney estimated that the trust could earn 7 percent and would continue to pay the Smiths 6 percent each year of the value of the assets in the trust*.

At their deaths, the remainder in the trust would pass without taxes or probate to the nonprofit organization they choose. Based on assumptions and his calculations, the nonprofit organization would receive $1,485,947 in 20 years. It would increase from the initial $1,000,000 because it was earning more than it was paying to the Smiths.

At their deaths, the remainder in the trust would pass without taxes or probate to the nonprofit organization they choose. Based on assumptions and his calculations, the nonprofit organization would receive $1,485,947 in 20 years. It would increase from the initial $1,000,000 because it was earning more than it was paying to the Smiths.

Furthermore, the Smiths would be able to take a current year charitable tax deduction (depending on their taxable income) of $417,710 with a tax saving in their 35% tax bracket of $146,199 (not including any state tax savings) and they would save $120,000 in capital gains tax (estimated capital gains tax liability had they sold the property outright). In addition, they could look forward (again, based on assumptions and current rates) to a total gross income of $1,214,868** over their estimated lifetime of twenty years.

Knowing that the trust would mean a wonderful thing for their nonprofit organization and that they would have higher income and fewer worries without the property itself, the Smiths decided to follow the attorney's suggestion.

See the graphic illustration of a charitable remainder trust below:

Example assumes a 2.4 percent applicable federal rate (AFR).

The IRS allows the AFR from the current or one of the two previous months to be used.

A higher AFR increases the charitable tax deduction for remainder interests.

* The assumption is that the 7% earnings are comprised of 3% income

and 4% appreciation

and the trust runs for twenty years.

** Assumptions are the trust earns 7 percent with the difference between

the 6 percent payout and the 7 percent earnings reinvested in the trust each year.